Bull Vs. Bear

Learn to trade your own money, make your own hours, be your own boss, live the dream lifestyle you deserve!

Making money in the market is as easy as 1-2-3

Don't worry, I am not selling trading get rich schemes, I think all new traders secretly dream of being rich. I can admit after my first few winning trades, I visioned my winnings to increase exponentially! I still (embarrassing) have old excel files predicting the growth of my trading account, in 2019 my trading account was projected to be nearing a cool million by now... yeah I thought/hoped that!

If I could talk to the rookie trader that I once was a long time ago, I would give myself two pieces of advice to research, study and practice fanatically.

1. The 80/20 Rule

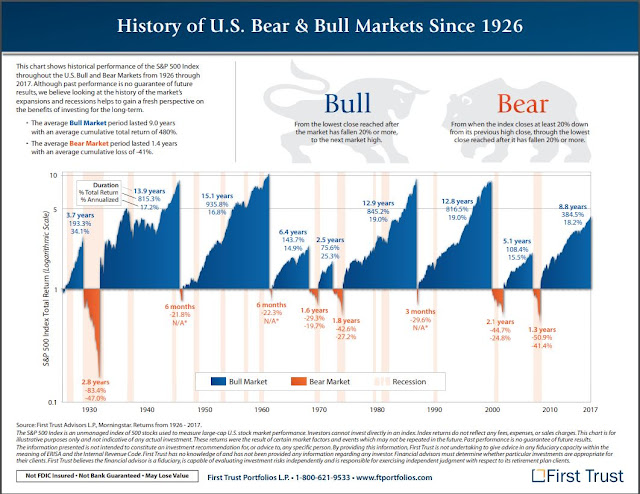

The average bull market lasts 8-10 years, with this knowledge/fact, 80% of trading capital is "invested" into various ETF's and or longterm options. This would be the slow steady growth account that is designed to mirror the market.

The remaining 20% of trading capital is used for the aggressive growth trading, this is the speculative (spec) account that is used to buy and sell technically traded charts.

2. Risk Management

Separate the slow growth account from the aggressive spec account. Rules need to be put into place on how and when capital is moved from accounts and how profits are consistently taken.

You are your worse enemy! I would warn myself to trade with the next 10 years in mind, not with the emotional swings of the daily market.

You are your worse enemy! I would warn myself to trade with the next 10 years in mind, not with the emotional swings of the daily market.

[I heard an interesting podcast about "How Buffet won a $1,000,000 bet", but I can't remember where?? click here to read an article about it.

Another good read: Bull Markets Last Five Times Longer Than Bear Markets by Robert Lenzner]It's been a while since I posted here on Trin Café, I must say I am surprised that this site still receives as much internet traffic as it does considering how neglected the site has been, not to mention the horrible spelling and egregious grammatical errors. With that said, thanks for checking in on the site, truly a labor of habit.

Take care and trade well!

- Trin